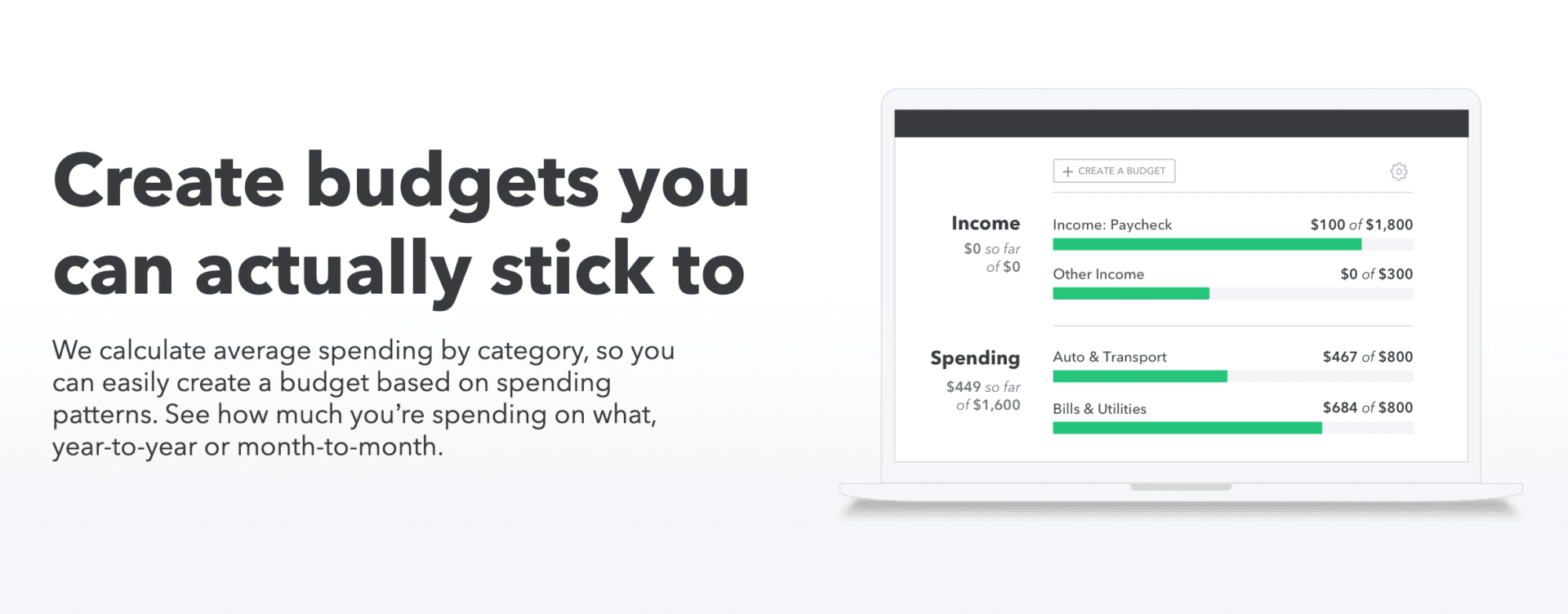

Due to the customization features, Money Dashboard is great for people who have lots of different accounts, or carry out quite complex transactions. It creates a graph of your projected monthly spending as well, with a predicted balance at the end of it. This can be really useful around Christmas for instance, to keep track of how much you have to spend. Money Dashboard offers up lots of similar features to Emma Pro… but at no cost! This means you can customise your spending categories and manually add as many accounts as you need. You can sometimes get inundated with notifications.It may be free, but there are lots of adverts which can be annoying.Easy to use and easy to find budgeting tools.It also sends you notifications and alerts if and when you go over your allotted budget, and offers you a really well-rounded picture of just where your money goes each month. What Mint is really good for is its budgeting tools, which you can find front and centre as you open up the app. You can track and manage your money from a huge list of banks and other finance lenders, and also has a great category setting available for your expenditure. One of the oldest and most well-known budgeting apps out there, Mint has it all.

#You need a budget review vs mint pro

Lots of push notifications about Emma Pro.Cashback with lots of stores (Body Shop, B&Q, Boots).Emma is particularly good for beginners, and is one of the best budgeting apps for managing your subscriptions.

And with the premium version of Emma, Emma Pro, you can access personalised categories and cashback initiatives. A handy addition to the subscription category is that Emma tells you how often you use it, or if you’re paying for something and not using it.Įmma will also show you all bank fees that you might get charged, which can be really handy to keep tabs on. These categories include things like subscriptions.

#You need a budget review vs mint for free

So how do you go about getting your finances under control? But we all might find it tricky from time to time – whether it’s that takeaway pizza you just need to have or that designer handbag – we’ve all caved at some point.

Let’s be honest, we could all hone our budgeting skills to put some extra cash away for a rainy day. Debt Relief Orders Explained and 2023 Criteria.Statute-Barred Debt – Time Limits, Your Rights & 2023 Laws.

Reducing Your Debt – What Are Your Options? 2023 Guide.Credit Card Debt – Options to Clear Your Debt.Council Tax Debt – New 2022 Laws & Your Rights.Car Finance Debt – New 2023 Laws & Your Rights.

0 kommentar(er)

0 kommentar(er)